This results in messy reporting, ambiguous outcomes, and a lack of comprehension of what's going on with all parts of your financial health. If you own a small business, you may have tried to manage your personal and corporate money using the same spending tracker app.

#EXPENSE TRACKING APP HOW TO#

It's not excellent for budgeting, but it's great for keeping track of your finances, especially your investments.Īlso Read: Guide on How to Manage Money Effectively | Money Management Skills to Manage Your Finances QuickBooks: The Best Application for Small Businesses The program then generates charts depicting your monthly financial flow, with the option to split expenditure by group and look deeper into any discrepancies you find. Personal Capital helps track and categorise all of your expenses made on a connected credit or debit card.

#EXPENSE TRACKING APP FREE#

It's filled with many investment advisers for contracts, but its free individual financial dashboard is equipped and open to anyone who signs up. Personal Capital is the ideal option if you largely have your financial situation resolved but want superior graphs and charts for your accounts. Have a look at the best budget tracker apps given below!Īlso Read: Top Apps to Manage Money - Manage Your Personal Finance With Money Manager App PERSONAL CAPITAL: Suitable for Investors These apps are also called expense manager apps. You can also look at a daily expenses app and act as an expense manager for yourself.

#EXPENSE TRACKING APP ANDROID#

You can also go for various applications available for iOS and Android to save money and analyse the money spent. You can earn money online through various odd jobs that pay a handful.

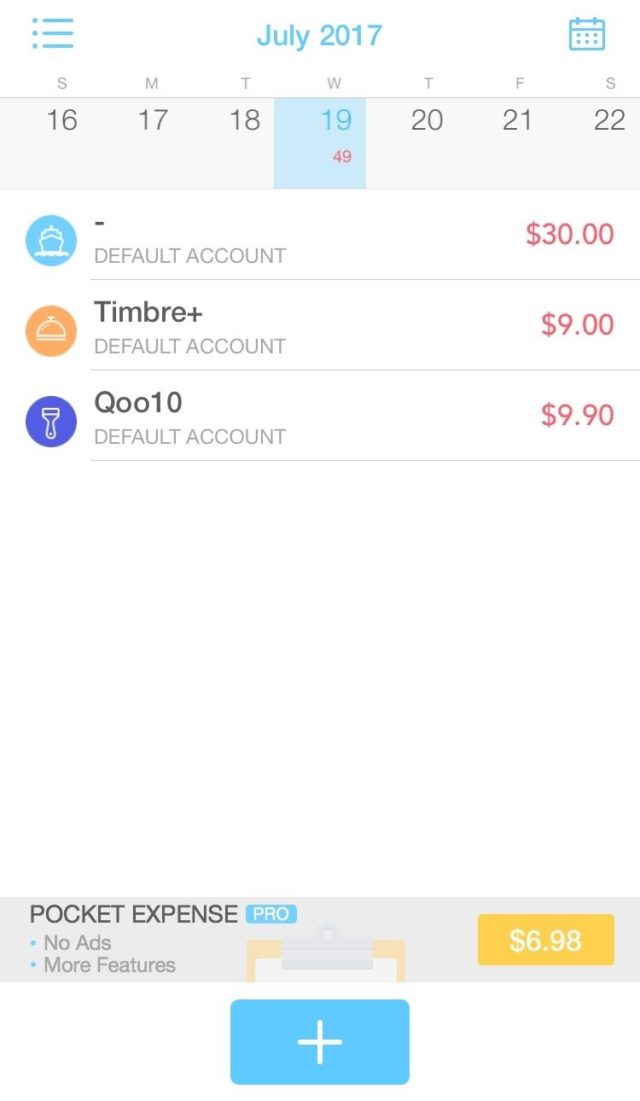

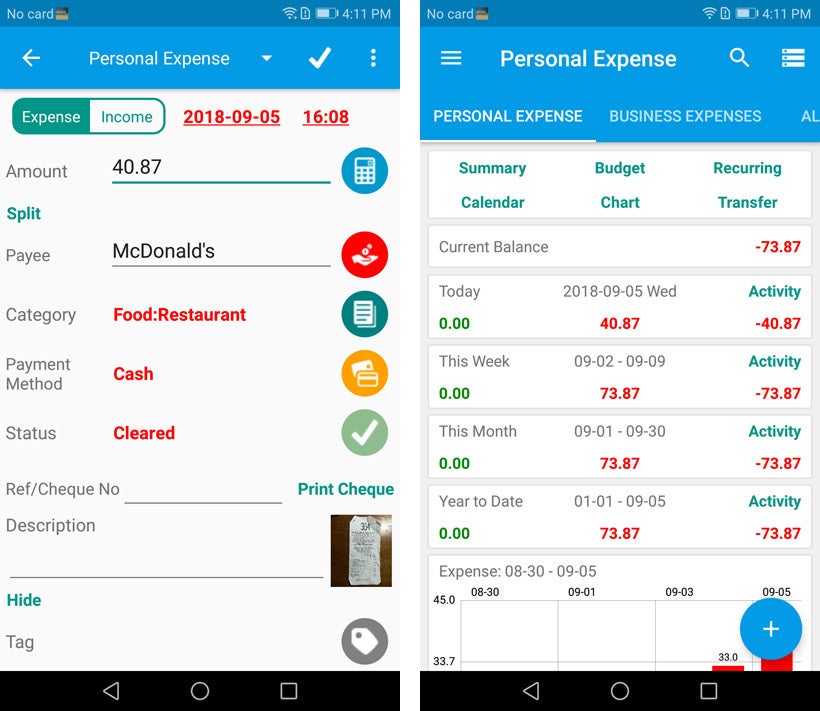

To avoid this, one can either save money or try to earn more money. Best iOS and Android Personal Expense Tracking Appsĭirect and indirect expenses lead to many cash crunch for businesses and individuals.

Although our list concentrates on free apps, you'll most likely need to pay a nominal fee to unlock all of the services you desire. These are the most prominent applications on the android and IOS platforms, but you'll probably have to try some before you discover one you enjoy. The aim is to transition from a pen and paper to some automated tool that saves you money. You use 20% of your take-home pay into savings, and the remaining 80% goes toward your expenses. It looks at your salary, which means your income after taxes, health insurance premiums, and other expenses are taken out of your monthly salary. The 80/20 rule of thumb is a good approach to saving money. Except for the number one iOS expenditure tracker software, the number of comments on Google Play for a query of " expense tracker s" is far higher than on the App Store.

And the app universes on iOS and Android are significantly different. You may keep track of your costs for a while merely to get a sense of where your income is spent, or it could be a first step toward creating and sticking to a budget.Īccording to reviews and popularity, the best applications are a shifting target. Or, if you're trying to improve your net worth, locations where you can put more money, like savings. That ranks pretty low on the enjoyable scale.Įxpense tracker applications let you collect and categorise your purchases so you can spot areas where you may save money. If you've ever wanted to improve the track of your cash flow, you realise that the very first step is to understand where you spend your income.

0 kommentar(er)

0 kommentar(er)